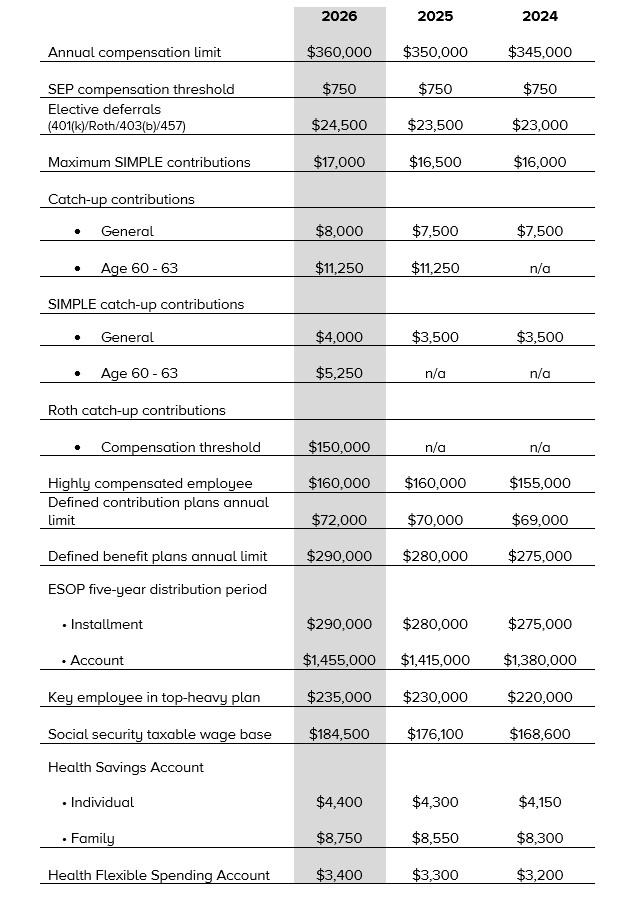

The Internal Revenue Service has announced the 2026 cost-of-living adjustments (COLAs) for benefit plans. They are as follows:

- Annual compensation limit. The compensation limit (IRC 401(a)(17)) applies for calculating benefits and contributions, for general and 401(k) nondiscrimination testing and for determining tax deductions.

- Elective deferrals (401(k)/Roth/403(b)/457). The calendar year contribution limit applies to pre-tax and Roth salary deferrals.

- Catch-up contributions. The calendar year dollar limitation applies for catch-up elective deferral contributions for individuals who, in 2026, are age 50 or above. Plan sponsors can add an optional “super” catch-up for employees reaching age 60-63 during the calendar year. For 2026, the annual limit for this enhanced catch-up is $11,250 (instead of $8,000) for most deferred compensation plans and $5,250 (instead of $3,500) for SIMPLE IRAs.

- Roth catch-up contribution timing. Roth catch-up contributions must be made during the 2026 calendar year (i.e. by December 31, 2026) for the contributions to count toward the 2026 plan year limit. Effective January 1, 2026, participants with FICA wages of over $150,000 (indexed from $145,000) in 2025 must make catch-up contributions on a Roth basis.

- Highly compensated employee. A “highly compensated employee” is one who (a) was a more-than-5% owner during the year or the preceding year, or (b) for the preceding year (i) had compensation in excess of $160,000 and (ii) if the employer elects for the plan year, was in the top-paid group (top 20% of pay) of employees.

- Defined contribution plans annual limit. The annual dollar limitation on total additions (both deferrals and employer contributions) applies to defined contribution plans for plan limitation years ending in 2026.

- Defined benefit plans annual limit. For plan limitation years ending in 2026, the annual dollar benefit limitation under a defined benefit plan has increased to $290,000. For participants who separated from service before January 1, 2026, the 100% of average high-three-years’ compensation limit is computed by multiplying the participant’s compensation limitation, as adjusted through 2025, by 0357.

- ESOP five-year distribution period. The dollar amount used in determining the maximum account balance in an employee stock ownership plan subject to a five-year distribution period has increased to $1,455,000 in 2026, while the dollar amount used to determine the lengthening of the five-year distribution period is increased to $290,000.

- Key employee in top-heavy plan. In defining who is a key employee in a top-heavy plan, for plan years ending in 2026, the compensation threshold for an officer has increased to $235,000.

- Social security taxable wage base. The social security taxable wage base is the limit over which the retirement portion of FICA/FUTA taxes is not assessed (however, Medicare taxes are still collected).

For more information, contact your Fredrikson attorney.