State of the SEC’s Climate Disclosure Rule

In March 2024, the Securities and Exchange Commission (SEC) adopted new climate disclosure rules requiring publicly traded companies to provide comprehensive information about their climate-related risks and impacts. These rules mandate narrative disclosures covering governance, risks, strategy, targets, goals, and—for larger filers—emissions and attestations. Additionally, companies must include climate-related financial information in their notes to financial statements, such as the impact of severe weather events and carbon offsets. The rules also require iXBRL tagging for enhanced accessibility.

Even though the SEC has voluntarily stayed the effective date of its climate disclosure rules in response to current legal challenges, the Commission has indicated that it intends to vigorously defend the rules, and that its 2010 guidance about climate change disclosure continues to apply. Moreover, at this point, the stay does not expressly affect the compliance dates under the rules, which are tied to specific fiscal years, beginning with 2025 data for large accelerated filers. It will take a significant amount of time for each company to analyze the application of the rules, obtain internal approval for compliance resources, engage service providers, and conduct the required materiality analyses. In addition, there are other regulations on the horizon. This means that U.S. publicly traded companies should continue to move forward with their climate disclosure efforts.

Materiality (Still) Matters

Unlike the rules that the SEC had initially proposed, which were very prescriptive, nearly all elements of the final climate disclosure rules are based on whether the applicable item is “material” to the company. In defining “materiality” for the purpose of climate disclosure, the SEC emphasized that companies should apply the longstanding, fact-specific test of whether a reasonable investor would consider the information important when determining whether to buy, sell, or vote the securities, and whether a reasonable investor would view the omission of disclosure as having significantly altered the “total mix” of information.

Although “traditional” materiality qualifiers are a welcome aspect of the final rule, the analysis is complex, and the subject matter differs from what companies are accustomed to considering for purposes of SEC filings. The determination of materiality is based on both quantitative and qualitative factors. For example, with respect to a particular risk, companies should consider the magnitude of the risk as well as how likely it is to occur. Cross-functional subject matter experts may need to be involved in this determination.

The following list identifies key elements of new Regulation S-K subpart 1500 that require a materiality analysis, along with questions to consider. This is a non-exclusive list. The questions are derived from the SEC’s adopting release and 2010 guidance, as well as the topics that must be addressed if disclosure is triggered.

- Item 1502 “Strategy and Risk” disclosure: Describe material climate-related risks. Unlike the principles-based disclosure in traditional “risk factors,” this Item 1502 disclosure must address a litany of specific issues identified in the rule. When determining materiality, consider these items:

- Strategy, business resiliency, results of operations, and financial condition.

- Time frame: Is it a risk that could materialize within the next 12 months? Is it a risk that will have a long-term impact on the company?

- Physical risks:

- Does it affect a significant facility, significant operations, significant processes?

- Does it affect many geographic locations or a small number (for the company or for customers/service locations)?

- Does mitigation involve a significant expense?

- Is there reasonably priced insurance to cover a loss?

- Consider both acute (event-driven, like a tornado) and chronic (like sustained high temperatures or sea-level rise).

- Transition risks:

- Has the company made an emissions reduction commitment that will expose it to risks related to implementing that commitment?

- Will there be changing customer, business counterparty, and/or investor preferences that affect the company’s business in a material way? For example, does the company offer carbon-intensive products that may experience reduced demand in a transition economy or require lower pricing/profit? Are there other competitive pressures or reputational impacts (including those stemming from the company’s customers or business counterparties) that might trigger changes to market behavior, consumer preferences or behavior, and company behavior?

- Is the company subject to climate-related laws or policies that will be expensive to comply with or that will affect its ability to do business in certain jurisdictions (e.g., in Europe)?

- Will there be transition-related technology that will pose an opportunity or risk for the company?

- Will the company need to devalue or abandon assets?

- Is there a risk of legal liability or litigation defense costs?

- Item 1502 “Impact on the Company” disclosure (i.e., Climate MD&A): In either tabular or narrative form, describe the actual and potential material impacts of the material climate-related risks identified above on the company’s business, results of operations, and financial condition. Note that, unlike the European regulations, this analysis focuses on the impact on the company, rather than the company’s impact on the environment. Consider financial planning, capital allocation, and overall strategic direction, with respect to:

- Business operations—including the types and locations of operations.

- Products and services.

- Suppliers, purchasers, counterparties to material contracts.

- Activities to mitigate or adapt to climate-related risks (including adoption of new technologies or processes). Are there material impacts on financial estimates and assumptions that directly relate to these activities?

- Expenditures for R&D.

- Are these impacts integrated into the business model or strategy? Are resources being used to mitigate these impacts?

- Has the company incurred (or does the company expect to incur) quantitative and qualitative material expenditures to mitigate or adapt to material climate-related risks?

- Item 1502 “Transition” disclosure: If the company has adopted a transition plan to manage a material transition risk, describe the plan. Discuss material expenditures incurred and material impacts on financial estimates and assumptions as a direct result of the transition plan. For example, consider whether the company’s reported results or financial condition will be significantly different if the estimates and assumptions turn out to be inaccurate.

- Item 1502 “Scenario Analysis” disclosure: If the company uses scenario analysis to assess the impact of climate-related risks on its business, results of operations, or financial condition, and if, based on the results of such scenario analysis, the company determines that a climate-related risk is reasonably likely to have a material impact on its business, results of operations, or financial condition, the company must describe each such scenario including a brief description of the parameters, assumptions, and analytical choices used, as well as the expected material impacts, including financial impacts, on the company under each such scenario.

- Item 1502 “Internal Carbon Price” disclosure: If a company’s use of an internal carbon price is material to how it evaluates and manages a material climate-related risk, disclose the price per metric ton of CO2e and the total price.

- Item 1503 “Risk Management” disclosure: Describe any processes the company has for identifying, assessing, and managing material climate-related risks. Among other items, a company should address how it identifies whether it has incurred or is reasonably likely to incur a material physical or transition risk, and whether and how these processes have been integrated into the company’s overall risk management system, if there is a material climate-related risk to manage.

- Item 1504 “Targets or Goals” disclosure: Describe climate-related targets or goals if they have materially affected or reasonably likely to materially affect the company’s business, results of operations, or financial condition.

- Does the company promote being “net zero” or similar commitments? If so, what is driving the decision to adopt those goals?

- Will targets/goals be required for doing business in important jurisdictions, and/or will they be required by important customers, business partners, or investors?

- Will there be significant expenses associated with meeting the targets or goals?

- Will there be significant negative impacts if the targets or goals aren’t met?

- How much of the company’s activities are affected by the targets or goals?

- Are executive compensation plans tied to achievement of targets or goals?

- Are carbon offsets or RECs a material component of the plan to meet climate-related targets or goals?

- Note, this may create a disincentive to adopt climate targets or goals.

- Item 1505 “Emissions” disclosure (Scope 1 and 2): For companies that are not Smaller Reporting Companies or Emerging Growth Companies, disclose material Scope 1 and/or Scope 2 emissions, as well as any constituent gas of the disclosed emissions that is individually material. Materiality is not determined merely by the amount of the emissions, but based on whether a reasonable investor would consider the information important.

- Is the calculation and disclosure necessary to allow investors to understand whether those emissions are significant enough to subject the company to a material short- or long-term transition risk?

- Is the company required to report emissions in any jurisdictions (foreign or state)—and does that suggest that the company is currently or reasonably likely to be subject to additional regulatory burdens? For example, increased taxes, financial penalties, or expenses of doing business.

- Has the company disclosed a target, goal, or transition plan? If so, emissions disclosures may be necessary to enable investors to understand whether the company has made progress. However, this disclosure may be qualitative. This is not a “back door” to requiring quantified emissions disclosure that is not otherwise mandated by the rule—i.e., Scope 3 emissions for larger companies or Scope 1 or 2 emissions disclosure for Smaller Reporting or Emerging Growth Companies.

- Note, the fact that the company is exposed to a material transition risk does not necessarily result in its Scope 1 and Scope 2 emissions being de facto “material.” For example, the company could reasonably determine that it is exposed to a material transition risk for reasons other than its GHG emissions, such as a new law or regulation that restricts the sale of its products based on the technology it uses, not directly based on its emissions. Such a risk may trigger other disclosures, but not emissions.

- Note, you may need to calculate emissions just to determine whether or not they are material.

In assessing materiality, companies may also benefit from considering the Industry Standards published by the Sustainably Accounting Standards Board (SASB). The SASB Standards continue to be maintained by the IFRS Foundation, whose reporting standards are being endorsed as a global baseline in many countries, and in fact are required to be considered under IFRS S1.

Other Considerations

Financial Statement Disclosures

In addition to adding many line-item disclosure requirements to Regulation S-K, the SEC’s climate disclosure rules also add a new Article 14 to Regulation S-X, requiring, in the notes to financial statements:

- A discussion of the financial impacts of severe weather events and other natural conditions, subject to certain de minimis disclosure thresholds. Companies must describe capitalized costs, expenditures expensed, and charges and losses incurred, if they exceed the thresholds set forth in the rule and if a severe weather event or natural condition is a significant contributing factor to the cost, expense, charge or loss.

- The aggregate amount of any recoveries recognized during the fiscal year as a result of severe weather events and other natural conditions for which the financial impact is required to be disclosed. Companies must also identify where the recoveries are presented in the income statement and balance sheet.

- Information about the accounting policy and financial impacts of the use of carbon offsets or renewable energy credits or certificates, if used as a material component of the company’s plan to achieve climate-related targets or goals.

- Disclosure of whether the estimates and assumptions used to produce the financial statements were materially impacted by risks and uncertainties associated with, or known impacts from, severe weather events and other natural conditions, and if so, a qualitative description of the impact.

The new Article 14 requirements apply to smaller reporting companies and emerging growth companies, in addition to other filers. Examples of disclosable costs and expenses may include relocation or repair of assets. There is no requirement to determine whether a weather event was caused by climate change. Companies should determine what constitutes a severe weather event or other natural condition based on their own facts and circumstances—including geographic location, historical experience, and the financial impact of the event on the company, among other factors.

Note that although disclosure of expenditures and costs is triggered under the SEC rules—only if they exceed a 1% disclosure threshold—that requirement does not affect a company’s ongoing responsibility to consider material impacts, whether climate-related or not, when preparing their financial statements and related disclosures. This may include determining whether costs and expenditures that do not trigger the disclosure threshold may be material to the company, taking into consideration all relevant quantitative and qualitative factors. In addition, although the SEC declined to require financial statement disclosure about transition activity expenditures, companies must continue to follow applicable accounting standards. In some situations, accounting standards may require disclosures of material expenditures within the financial statements, including material expenditures related to transition activities.

Emissions Disclosures and Attestations

Many companies will be required to disclose their Scope 1 and/or Scope 2 greenhouse gas emissions under new Item 1505 of Regulation S-K. The disclosure requirement applies to material GHG emissions for the most recently completed fiscal year and, to the extent previously disclosed in a Commission filing, for the historical fiscal year(s) included in the consolidated financial statements in the filing. For any GHG emissions required to be disclosed, the company must disclose:

- The company’s Scope 1 emissions and/or Scope 2 emissions separately, each expressed in the aggregate, in terms of CO2e. For example, if a company’s Scope 1 emissions are material but its Scope 2 emissions are not material, then, under the final rules, the company must disclose its Scope 1 emissions, but the company would not be required to disclose its Scope 2 emissions (and vice versa if the company’s Scope 2 emissions are material but its Scope 1 emissions are not material). If a company’s Scope 1 and Scope 2 emissions are both material, then it must disclose both categories of emissions.

- Constituent gas, disaggregated from the other gasses, if any constituent gas of the disclosed emissions is individually material (e.g., methane).

- The company’s Scope 1 emissions and/or Scope 2 emissions in gross terms by excluding the impact of any purchased or generated offsets.

- The methodology, significant inputs, and significant assumptions used to calculate the disclosed emissions—including the organizational boundaries, operational boundaries, and the protocol or standard used to report the emissions; including the type and source of any emissions factors used, the calculation approach and any tools used to calculate emissions.

The final SEC rule does not mandate “Scope 3” emissions disclosures (or Scope 1 & 2 for Smaller Reporting Companies and Emerging Growth Companies). However, companies should be mindful that disclosures made under other regulatory regimes may be viewed by investors and the SEC, which may result in requests for qualitative Scope 3 emissions disclosures relating to material transition plans and other matters.

The emissions disclosures will be a new line item for Form 10-K and will apply to large accelerated and accelerated filers, but not emerging growth companies or smaller reporting companies. If needed, companies may provide the information no later than the due date for their second quarter Form 10-Q, either by incorporating to the Form 10-Q or by amending the Form 10-K.

In addition, companies that are required to provide Scope 1 and/or Scope 2 emissions disclosure will be required to obtain, from an independent expert, an attestation report about their emissions disclosures. For large accelerated filers, the attestation report initially must be provided at a limited assurance level, for fiscal years that begin in 2029 through 2032, and at a reasonable assurance level for fiscal years that begin in 2033. For accelerated filers (other than smaller reporting companies and emerging growth companies), attestation is required at a limited assurance level for fiscal years that begin in 2031.

Companies that are not required to obtain an attestation report, but that voluntarily obtain third-party assurance, will be required to disclose information about the assurance provider and the assurance standard. This requirement can apply to companies that are not subject to the attestation requirements due to being a smaller reporting or emerging growth company, as well as to larger companies that provide voluntary assurance prior to the compliance date for attestation. That is something that many companies may do in light of the complexity of these disclosures. In addition, large accelerated filers and accelerated filers that voluntarily quantify Scope 3 emissions in SEC filings and that obtain voluntary third-party assurance for that information will need to comply with the attestation requirements that otherwise apply to emissions disclosures.

Although there is no extended compliance phase-in for companies that cease to qualify as “emerging growth companies,” it is worth noting that a company will be exempt from the GHG emissions disclosure requirements in the first fiscal year in which it no longer qualifies as a smaller reporting company. That’s because a company must reflect the determination of whether it came within the definition of a smaller reporting company in its quarterly report on Form 10-Q for the first fiscal quarter of the next year, which will be after the date of the annual report on Form 10-K in which the GHG emissions disclosure is required. There is no requirement to disclose GHG emissions for prior years before reporting was required.

Forward-Looking Statements Safe Harbor

New Item 1507 of Regulation S-K expressly extends the Securities Act and Exchange Act safe harbors for forward-looking statements to non-historical information provided about transition plans, scenario analysis, internal carbon pricing, and targets and goals. While many of these types of statements would have already been covered by the existing PSLRA statutory safe harbors, unlike the “typical” PSLRA safe harbor, this regulatory accommodation also applies to statements made in connection with an initial public offering. The safe harbor applies to disclosures that contain one or more of the following statements:

- A statement containing a projection of revenues, income (including income loss), earnings (including earnings loss) per share, capital expenditures, capital structure, or other financial items.

- A statement of the plans and objectives of management for future operations, including plans or objectives relating to the products or services of the company.

- A statement of future economic performance, including any such statement contained in a discussion and analysis of financial condition by the management, made pursuant to Commission rules.

- Any statement of the assumptions underlying or relating to the above statements.

- A statement containing a projection or estimate of items specified by Commission rule or regulation.

To get the benefit of the Item 1507 safe harbor, forward-looking statements must be accompanied by meaningful cautionary statements that identify important factors that could cause actual results to differ materially from those in the forward-looking statement.

Consistent with the limitations of the PSLRA, the safe harbor does not apply to statements of historical fact (such as material expenditures actually incurred). It also does not apply to forward-looking statements included in financial statements, or to forward-looking statements that are incorporated by reference from the financial statements.

Interplay with Other Reporting Frameworks and Existing Voluntary Reports

While companies can take some comfort that the SEC’s final disclosure rule is riddled with materiality qualifiers, the SEC rule is not the only game in town. Many companies are also navigating the European Union Corporate Sustainability Reporting Directive (CSRD), which applies a “double materiality” standard that assesses the company’s impact on the environment and stakeholders in addition to the more traditional concept of whether an issue would have a material impact on the company’s financial position, and California climate disclosure laws, which will require emissions disclosure (including Scope 3) for covered public and private companies regardless of materiality. Moreover, many companies already voluntarily publish sustainability or ESG reports that address topics covered by the SEC rules, but that historically may not have been subject to the same level of rigor as an SEC filing.

Companies will need to consider existing disclosures and other regulatory regimes as part of their SEC climate disclosure strategy (and vice versa). For most companies, it is unlikely that a single report will be able to serve every purpose, without unduly increasing liability exposure. This means that companies will need to carefully track information that is responsive to each regime and ensure that there are no inconsistencies in what is reported. It would not be surprising if the SEC or other potential litigants scour these disclosures in an effort to identify discrepancies. It may be helpful to create a real-time record that reconciles the different disclosure decisions under various standards, which can be done by documenting the applicable standard and analysis under each regime—ideally under attorney-client privilege.

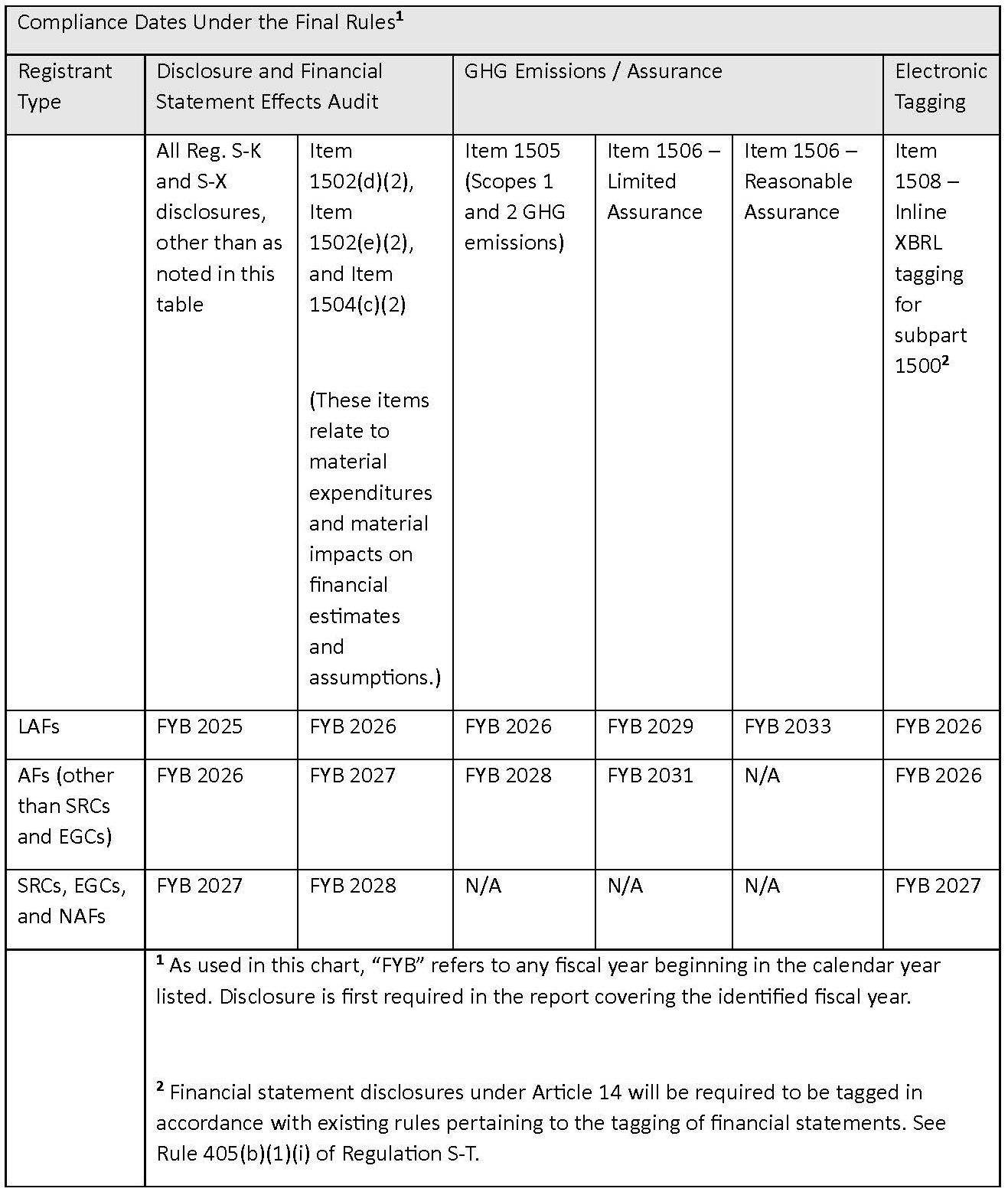

Compliance Dates and (Non) Impact of SEC Stay

On April 4, 2024, the SEC issued a voluntary stay of the effective date of the climate disclosure rules, pending completion of judicial review of a number of petitions challenging the rules, which have been consolidated in the Eighth Circuit. The stay prevents the rules from going into effect. However, it does not expressly affect the compliance dates that are set forth under the rules, which are tied to specific fiscal years rather than the rule’s effective date. At this point, it is uncertain whether those dates will be extended if all or part of the SEC rule survives legal challenge. Thus, for larger companies that are subject to a compliance date requiring collection of data throughout 2025, and that may have more data to collect and verify, the stay may have little practical impact. The rules, as adopted, provide for the following compliance dates:

Click here to view the table.

What To Do Now

Preparing for climate disclosure is akin to completing a jigsaw puzzle: It may not be a linear process, but eventually, you can assemble a complete picture. The following steps will help you bring your company’s climate-related compliance requirements into focus:

- Map Regulatory Requirements and Commitments: Map the specific disclosure requirements outlined by each regulatory body whose laws may apply to your company (SEC, California, EU), as well as existing voluntary disclosure commitments, to identify commonalities and differences. This effort will include understanding key definitions and disclosure triggers, which likely differ across frameworks. Stay informed about regulatory developments and adjust disclosure plans and practices accordingly. Because SEC disclosure becomes much more onerous when exiting smaller reporting and emerging growth company categories, companies should also closely monitor their SEC filer status. Similarly, companies should monitor revenue and other triggers that affect the application of California and EU rules.

- Build Your Cross-Functional Working Group: Complying with the climate disclosure rules will require input from several corporate functions, such as sustainability, procurement, product development, internal audit, investor relations, legal, and finance. Now is the time to assess whether the appropriate functions are represented in this effort and how information will be reported out to your disclosure committee. This exercise will allow you to identify areas where your team may need additional training or capacity to effectively manage and disclose climate-related information.

- Assess Current Practices: Perform a detailed gap analysis to assess the company’s current climate-related disclosure practices against the requirements of each regulatory body. Identify areas where additional information or adjustments may be needed, and areas where processes can be improved.

- Enhance Governance and Risk Management Processes: Review board and management committee charters and other governance documents to accurately reflect the climate risk oversight process. Incorporate climate risk considerations into overall enterprise risk management systems to assess materiality. However, recognize that these systems may need to be enhanced in order to reflect the type of comprehensive, cross-functional materiality analysis that the SEC rule appears to contemplate and that the EU CSRD establishes. If a material risk is identified, your working group should next identify applicable disclosure line items. Additionally, if appropriate in light of materiality determinations, incorporate climate risk discussions into board and/or committee updates. As noted above, it will be helpful to structure internal analyses in a way that affords protection under attorney-client privilege.

- Engage Stakeholders: Engage with investors, regulators, and other stakeholders to understand their expectations and concerns regarding climate disclosure. Stakeholder engagement is a key component of the double materiality analysis under the EU CSRD.

- Develop Internal Controls and Disclosure Controls—and Document and Test Them: Establish robust data management systems to collect, analyze, and report climate-related data accurately and efficiently. It will be important to test these processes to ensure they work as intended. Your financial and non-financial data must be accurate, consistent and reliable over time, and must provide management with the ability to make disclosure decisions on a timely basis. Ensure data integrity and consistency across different reporting frameworks. Document your internal controls and procedures, especially with respect to reconciling differences in disclosures for different jurisdictions. In addition, note that the disclosures required by new Article 14 of Regulation S-X, as part of the company’s financial statements, will be subject to internal control over financial reporting.

- Consider Disincentives: The SEC rule may create disincentives to establish targets or goals and transition plans, or to conduct a scenario analysis, because doing so may trigger detailed disclosures. Many companies have already taken these steps for business planning reasons or in response to investor requests, and it will be difficult to unwind what has already been done. Companies that have not already analyzed the impact of different climate-related scenarios on the company’s business and financial outlook, set targets or goals, or established transition plans, should carefully weigh the pros and cons of these activities before proceeding.

- Collaborate with Industry Peers: Collaborate with industry peers and participate in industry initiatives or working groups focused on climate-related disclosure. Share best practices, exchange information, and leverage collective expertise to improve disclosure processes. If your peers are disclosing particular categories of information, consider that you may need more persuasive backup for a decision that the topic is not material to your company.

- Engage Service Providers: Seek guidance from legal counsel to understand the legal implications of climate disclosure rules and ensure compliance with applicable regulations. Consult with advisors and non-financial accountants to ensure that the company’s reporting practices align with regulatory requirements and industry standards and that the company will be able to comply with attestation requirements, if and when applicable.

- Prepare Draft Disclosures and Monitor Your Compliance Plan: Begin drafting climate-related disclosures, incorporating relevant information and data gathered through the preparation process. Continue to monitor your compliance plan to ensure that it aligns with evolving regulatory expectations and litigation developments.

By taking a proactive and strategic approach to preparing for enhanced climate-related disclosure, the complexities of navigating multiple disclosure frameworks will be more manageable, and disclosures will be less prone to error.