Overview

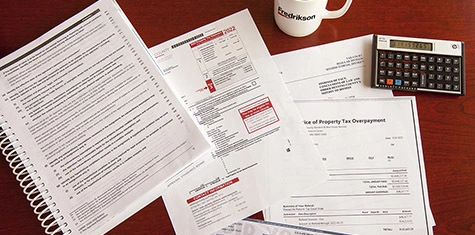

Dylan has experience conducting legal research and guiding clients through tax disputes and controversies, including audits, administrative appeals and litigation. Among other things, he assists with corporate income and franchise tax disputes, complex SALT matters, offers in compromise, sales and use taxes, and property tax appeals.

Dylan helps clients resolve the following types of tax disputes:

- State Corporate Income and Franchise Taxes: including nexus, Public Law 86-272, business versus non-business income, allocation and apportionment and federal preemption.

- Property Taxes: including real property valuation and administrative appeals for companies in a wide variety of industries, including hotels and public utilities.

- Sales and Use Taxes: including exemptions, nexus and sourcing issues.

- Individual Income Taxes: including criminal tax matters and offers in compromise.

Services

Experience

State Corporate Income & Franchise Taxes

- Assisted multi-state health care company in protesting franchise taxes imposed in novel sourcing dispute.

- Supported international brewing company in complex Public Law 86-272 litigation.

Property Taxes

- Conducted and contested valuations of corporate property in the hotel industry.

- Researched and analyzed property valuations for public utility company confronted with conflicting state tax issues.

Sales & Use Taxes

- Partnered with corporate clients to plan sales tax strategies and conduct risk assessments.

Individual Income Taxes

- Worked with high net worth and pro bono clients in audits, underreporting issues and offers in compromise.

Credentials

Education

- University of Minnesota Law School, J.D., 2023, magna cum laude

- Macalester College, B.A., 2015, cum laude

Admissions

- Minnesota, 2023

Recognition

- North Star Lawyer, Minnesota State Bar Association, 2024

- Wennerstrom Award for Excellence in Clinical Legal Services, University of Minnesota Law School, 2023

Civic & Professional

Professional Activities

- Minnesota State Bar Association, Tax Law Section, 2023-present

- University of Minnesota Law School Child Advocacy & Juvenile Justice Clinic, Student Attorney, 2021-2022; Student Director, 2022-2023

- Minnesota Law Review, Staff Member, 2021-2022; Lead Managing Editor, 2022-2023

- American Constitution Society-University of Minnesota Law School, President, 2021-2023

Community

- Macalester College, Assistant Cross Country Coach, 2020

- Breakthrough Twin Cities, Teaching Fellow, 2013-2014; Dean, 2019-2020

- Minnesota Alliance With Youth, AmeriCorps Promise Fellow, 2018-2019

News & Insights

News

Speaking Engagements

Legal Updates

Publications & Presentations

- Author, “School Curricula and Silenced Speech: A Constitutional Challenge to Critical Race Theory Bans,” Minnesota Law Review, 2023

- Author, “Capacity and Necessity: The Appropriateness of Judicial Policymaking in Affirmative Action,” Pi Sigma Alpha Undergraduate Journal of Politics, 2015